Main Breeding and Marketing Species

Global supply of Atlantic salmon maintained strong y-o-y volume growth in 2021

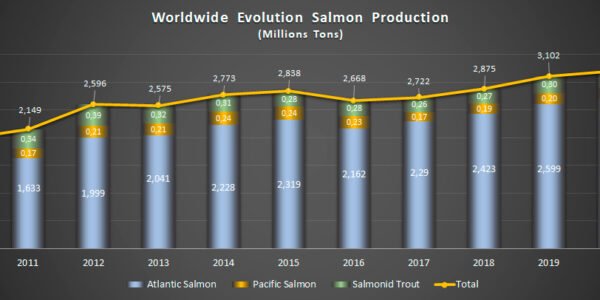

The global harvest of farmed Atlantic salmon increased by an estimated 168,000 tonnes (+6.2%) y-o-y during calendar year (CY) 2021 to 2.88 million tonnes. The growth was driven by robust Norwegian supply, where technological innovation, alongside plentiful feed availability from Jul-Oct ‘21, facilitated larger individual fish. Unseasonably warm seawater temperatures during the second-half of the CY 2022 (H2 2022) also contributed to atypically fast smolt growth. These factors resulted in estimated Norwegian salmon supply increasing by approximately 151,848 tonnes (+11.1%) y-o-y in 2021 to 1.52 million tonnes

Mintec anticipates that Norwegian supply may tighten during the first-half of CY 2022 (H1 2022) versus H1 2021. This is based on a comparatively smaller biomass of 332,400 tonnes present on 1st Jan ‘22, compared to 370,300 tonnes for 1st Jan ‘21.

The lower biomass accounts for 10,300 fewer live fish y-o-y on 1st Jan ‘21, despite slightly higher weight per fish (4.1kg in Jan ’22 vs 4.0kg in Jan ’21)

The strong y-o-y growth recorded in Norwegian salmon production during the 2021 CY helped offset lower Chilean supply, which contracted by 72,000 tonnes (-9.3%) during the same period to 706,000 tonnes. This decline came as a reaction to weak demand and profitability in 2020, which prompted Chilean farmers to reduce restocking activities. High fish mortality rates associated with sea lice infestations and algae blooms further stunted Chilean farm yields in 2021. However, Chilean production is expected to accelerate during H1 2022, largely in response to the higher average prices and profitability gains recorded in CY 2021. The likelihood of firm demand from the Americas and Europe provides further impetus for the Chilean supply outlook

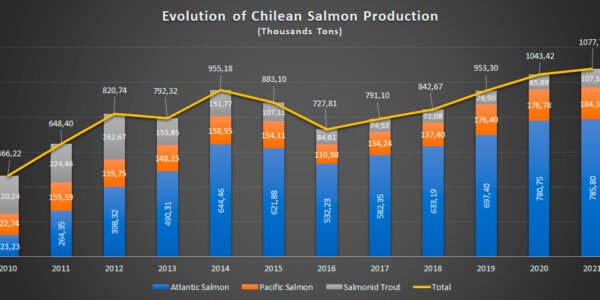

Chilean Salmon Production

Chile is the second producer of salmon globally, behind Norway. It concentrates around 27% of global production. Exports of this product ranked second after copper in 2021.

In 2020, the Chilean salmon industry exceeded the barrier of one million tons of harvest for the first time and for the second consecutive year it recorded the highest production in its history.

This was stated by the National Fisheries and Aquaculture Service (Sernapesca) in its 2020 Fisheries and Aquaculture Statistical Yearbook published by the agency last Friday, May 28.

The document details that in the last year the industry harvested 1,079,595 tons, the highest volume in its 40-year history. The figure represents an increase of 9.1% compared to 2019, when the sector had reached a production of 989,546 tons.

Chilean Salmon Exportations

Chilean salmon exports experienced a significant jump in 2021, returning to pre-pandemic levels. In addition, this sector ranked second in export value last year, ranking behind copper.

Salmon exports reached US$ 5,180 million, which represents a jump of 18.2% compared to the previous year, according to the annual report on salmon exports, prepared by the Chilean Salmon Council. In 2020, meanwhile, while the coronavirus gave no respite and hit the world hard, salmon exports fell by 14.9% compared to the previous year.

“There was a progressive recovery in salmon exports as 2021 progressed. Thus, while shipments fell 2.6% annually in the first quarter, increases of 11.6% were recorded in the second and third quarters. and 33.4% respectively when comparing them with the same quarters of the previous year. Finally, salmon and trout exports totaled US$1,549 million in the fourth quarter of 2021, 37.5% higher than the same quarter of the previous year,” the report indicated.

The main destination market for Chilean salmon in 2021 was the United States, followed by Japan, Brazil, Russia and Mexico. These five countries accounted for more than 85% of local exports of this product. The recovery in demand was led by the US and Brazil, with an annual increase of 33.7% and 63.5% respectively. Shipments to China and Russia, meanwhile, were down compared to 2020.

The outlook for the current year in the industry is positive, as long as the pandemic remains under control, and the dynamism in the growth of new distribution channels continues.

“We hope that there will be no greater restrictions due to covid after the Ómicron outbreak and that the opening of hotels and restaurants can continue, which, added to the growth of new distribution channels such as online and retail sales, allow us to maintain good projections for salmon farming. for this year that has just begun,” said Joanna Davidovich, executive president of the Salmon Council.

“The growth of salmon and trout exports has been greater in the last 10 years than that of total exports and that of the rest of the “non-copper” goods, with which they have been gaining relevance within total Chilean exports. , going from representing 6.9% of “non-copper” exports in 2010 to 12.5% in 2021″