Southern Hemisphere Apple Production

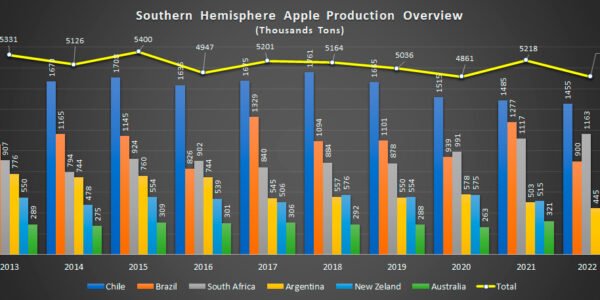

The forecast is made with data from Argentina, Australia, Brazil, Chile, New Zealand and South Africa, estimating that apple production will decrease 7% in 2022 compared to the previous year.

The forecast of the southern hemisphere apple harvest for 2022 suggests a decrease of 7%, totaling 4,864,000 T compared to last year (5,217,000 T), mainly due to the 30% decrease in Brazil and 11% in Argentina. A slight drop in production is also expected in Australia and Chile, of 3% and 2% respectively.

Southern Hemisphere Apple Production

Argentine Apple Exports by Destinations

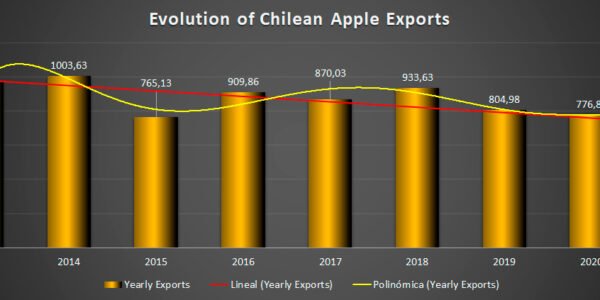

Production and Exports of Chilean Apples

Chilean apple production in the 2021/22 campaign would remain flat year-on-year and would total 1,090,000 tons, according to the latest USDA GAIN report.

The planted area will continue to be 32,300 hectares. Currently, Chilean growers are renewing apple trees with new varieties, but the planted area does not increase significantly due to competition from other crops (cherries, walnuts) that generate more profit.

Some of the new varieties of apples grown are Pink Lady, Rosy Glow, Brookfield Gala, Ambrosia, Buckeye and Modi. The producing regions are Maule (60.8% of the total), O’Higgins (23.9%) and Araucanía (9.5%).

Chilean apple exports in the 2021/22 campaign are expected to reach 637,000 tons, almost the same volume as in the previous campaign.

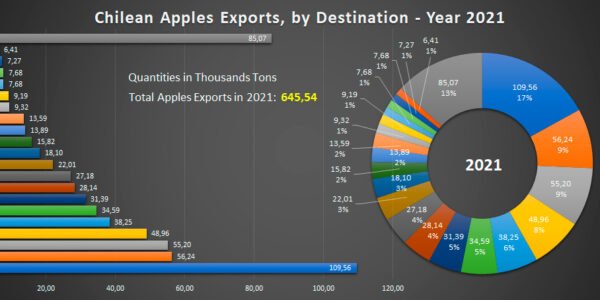

Last year, Chile supplied this fruit to 66 different countries, with the main recipients being the United States (59,031 tons), India (56,163 tons) and Colombia (52,304 tons).

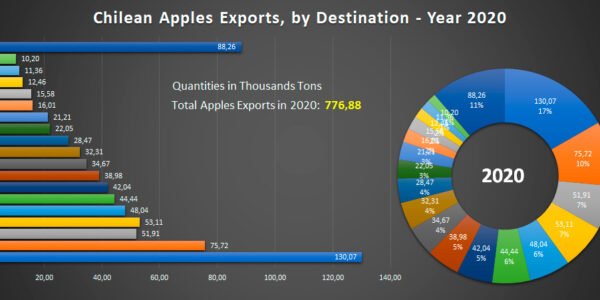

Main Destinations of Chilean Apple Exports

Chilean apple exports will reach 637,000 tons in the 2021/2022 campaign, which would not represent changes compared to the previous season, according to the annual report Fresh Deciduous Fruit for Chile from the United States Department of Agriculture (USDA). in English).

The USDA said “that the forecast closely follows the current production trend. In 2020-2021 (data through August), Chilean apple exports totaled 546,193 tons, a decrease of 3.7% compared to 2019-2020.” For 2021-2022, USDA estimated that the apple planted area will remain at 32,300 hectares.

“Growers are renewing current apple orchards with new varieties, but the planted area is not increasing significantly due to competition from other fruit crops that are more profitable,” the institution revealed, adding that “some of the new apple varieties apples in Chile are Brookfield Gala, Pink Lady, Rosy Glow, Ambrosia, Modi and Buckeye”.

Apple production in 2021-2022 will remain stable and total 1,090,000 tons, as the planted area will remain unchanged.

The USDA bases this projection considering the drought problems that Chile faces in the apple-producing regions and assuming that no unexpected meteorological events occur.

Chilean Apples Overview

Chile, with shipments close to 700,000 tons, is the main exporter in the southern hemisphere and apples currently rank third in terms of fruit export earnings, behind cherries and table grapes.

Due to the introduction of the new varieties of Gala, Fuji and Braeburn groups, the area had a significant increase since the 2000s. However, the area began to decrease from 2013 with 36,678 ha to the current 32,314 ha (Source: Ciren-Odepa/ IQonsulting).

As a consequence of warming and droughts, as well as more frequent late frosts, the apples of the Central Zone have suffered significant losses due to sunburn, as well as physiological disorders such as lenticelosis, bitter pit and superficial scald, along with accelerated ripening with less time to harvest and reduction in storage potential.

As a consequence, the productive zone gradually moved south from the mid-1990s, mainly to two macro-zones: Los Angeles – Angol and Traiguén – Freire.

The Galas, Fujis and Cripps Pink varieties adapted well in the Angol area, while in Traiguén-Freire the Braeburn, Elstar, Honeycrisp, Evelina, Jazz, Ambrosia and even Galas (although small in size) adapted better. It should be remembered that in cool climates in more mountainous locations such as Malleco and further north they also had a reasonable adaptation, but in this case with a much higher risk of hail and spring frosts.

The most notable trend is the growth of the Cripps Pink/Pink Lady Group and the decline of the Braeburn variety.