Brazil is the World's Largest Soybean Producer

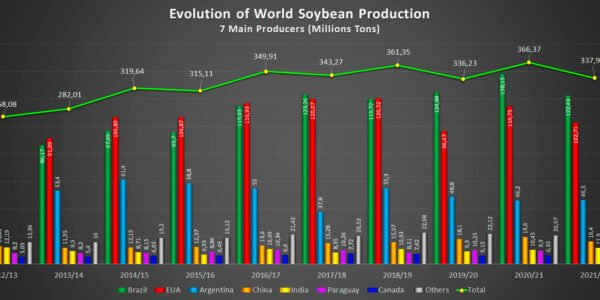

South America will produce more than half of the world's soybeans for the tenth consecutive campaign

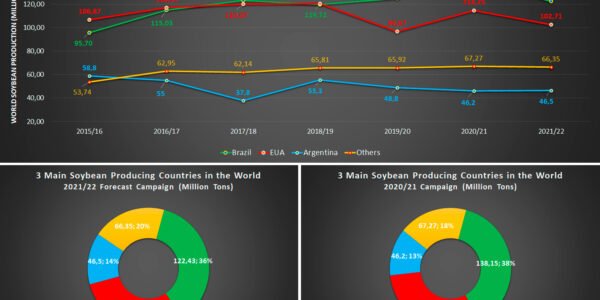

Uneven evolution: in the last 20 cycles, Brazil doubled its soybean harvest, Paraguay doubled it and Argentina only increased it by 50%. In contrast to the regional trend, our country contracted the area devoted to oilseeds.

The 2021/22 campaign will once again have four South American countries among the 10 largest soybean producers in the world. The combined harvests of the southern cone will represent 55% of global soybean production, maintaining the share achieved last season.

Two decades ago, South American production contributed 48% of the world’s beans, with a supply that was strongly concentrated in the United States (38% of world production). South America exceeded 50% participation in the 2007/08 campaign, when the relative weight of the United States fell to 33%. South American soybeans achieved the largest share of world supply during the 2019/20 cycle, contributing 57% of production. At that time, the result of the United States had decreased due to less planted area and lower yields.

Brazil's main crop

Soybean is the largest crop in Brazil and the grain continues to be of great importance in the economic trade balance, being a powerful engine that encourages exports and expands the frontiers of Brazilian agribusiness worldwide.

Campaign Status 2021/22

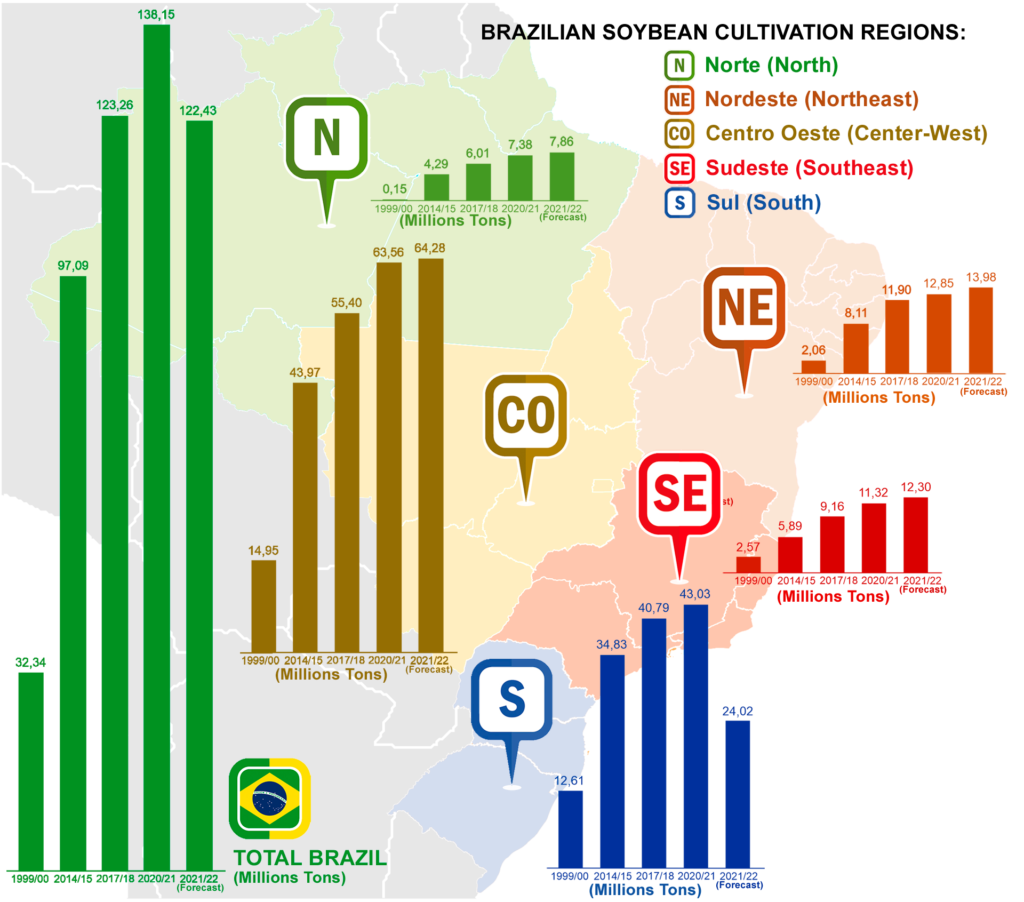

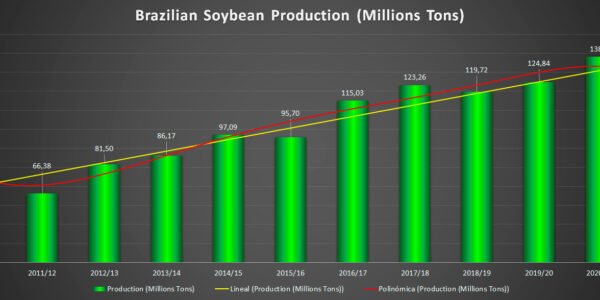

For the 2021/22 campaign, soybean production is forecast at 122.43 million tons, a reduction of 11.4% compared to the previous harvest (138.15 million tons). The good rainfall that occurred in practically the entire country helped in the recovery of a small portion of crops sown late in the South Region and in Mato Grosso do Sul, but did not reverse the decline in productivity, already announced in previous surveys.

Results of the last campaigns

Rio Grande do Sul remains the state most affected by the water deficit in November and December 2021, followed by Paraná and Mato Grosso do Sul. In the opposite scenario, most of the other states achieved higher yields than those obtained in the last harvest, with emphasis on Piauí, which has obtained 12.7% higher yields so far. Mato Grosso, Mato Grosso do Sul and Goiás are approaching the end of the harvest, surpassing more than 97% of the sown area.

Estimates indicate an average productivity of 3,000 kg/ha and a total production of 122.43 million tons, down 14.9% and 11.4%, respectively. The drop in production was not greater only due to the 4.1% increase in the sown area, reaching 40,804.9 million hectares in this harvest.

For the 2021/22 harvest, there was a reduction in the estimated exports of 3.16 million tons, from 80.16 million tons to 77 million tons.

There was an increase in crushing of 3.57 million tons from 42.93 million tons to 46.50 million tons.

The reduction in export estimates and the increase in domestic crushing are motivated by an expectation of lower soybean exports in the second half of the year, given that, with crushing margins very attractive, crushing and soybean oil exports should be high and, therefore, soy oil exports are now estimated at 1.56 million tons.

As a result of the increase in the estimate of soybean crushing in grains and the reduction in the estimate of exports, the carryover stocks of soybeans in grains are estimated at 2.52 million tons by the end of 2022.