The Avocado Boom In the United States

The United States is the main consumer market for avocados and is increasingly dependent on foreign production. The ratio between import and consumption has increased from 37% in 2001 to more than 90% in 2020, according to figures from the United States Department of Agriculture (USDA). In terms of production, the US crop has been stable to declining in recent years as the domestic industry in California faces several challenges. “Under these circumstances, the dependence of the US avocado market on imports will only increase in the future as consumption continues to expand.”

This in a context of sustained growth in consumption, which has increased by 8% annually during the last decade. In 2010, each American ate 1.88 kilos on average; in 2018, it was around 3.8 kilos. “Avocado consumption could exceed 5kg per person per year by 2026,” says the report.

Twenty years ago, he mentions that most US avocado imports came from Chile, since Mexico still faced sanitary restrictions in this market. Since the sanitary restrictions for avocados from Michoacán, the main producing region of Mexico, were lifted, exports from this country have dominated the US market. On the contrary, he reports that imports from Chile have practically disappeared, as Chilean producers have focused on other export markets, as well as the expanding domestic market. “In the future, we will see the US importing more avocados from Peru and Colombia”.

South American Avocado

The joint production of Peru, Chile and Colombia has established itself as the second most important supplier of the fruit, also called avocado, after Mexico. According to the financial firm of Dutch origin, its export in 2021 will close at 700,000 tons to reach one million in two years.

Peru, the leader. Chile, the mature industry. Colombia, the revelation. These are the three protagonists that the financial firm Rabobank highlights in the emergence of the South American avocado worldwide.

According to a recent report from the financial entity, guacate exports from the sub-continent have been increasing since 2014 and will reach more than 700,000 metric tons this year. And, if the trend continues, exports will exceed one million tons in the next two years.

Export Industry

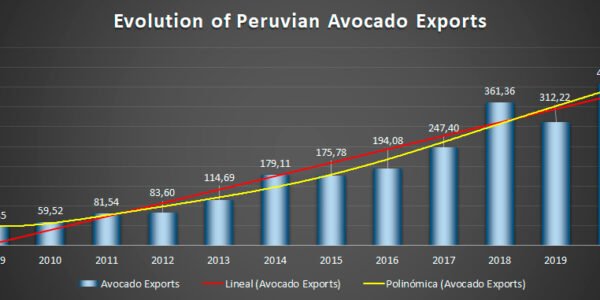

Most of that figure originates from Peru. The country ended 2021 with a record figure of more than 550,000 metric tons exported.

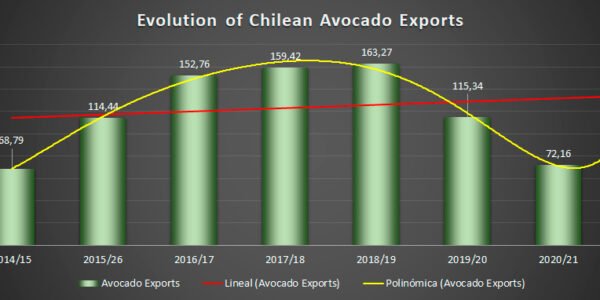

Chile, the first South American country to develop an avocado export industry. Chile, the first South American country to develop an avocado export industry, according to Rabobank, had a difficult 2020/21 season, with a 40% decrease in production. This caused a similar drop in exports but helped keep value high.

For its part, Colombia, the third player, shows the highest expansion rates, with an average annual growth of 57% between 2016 and 2021. It is also the only country that produces avocados throughout the year.

Technical Specifications

NAME: Avocado (American Persea )

FAMILY: The avocado belongs to the family of Lauraceae, domesticated since pre-Inca times.

DESCRIPTION: The fruit is a berry, of a seed, of mesocarp fleshy and very pleasant, with cells rich in oils that contribute, content 12 vitamins of the 13 existing, high vitamin E and K, and all B vitamins.

It is also rich in minerals. According to the variety the skin can mature purple almost black (‘Hass’) or green (‘Strong’).

The endocarp that surrounds the seed is thin and light yellow. The weight of the fruit is approximately 450 g.

Its origin is the inter-Andean valleys.