Coffee

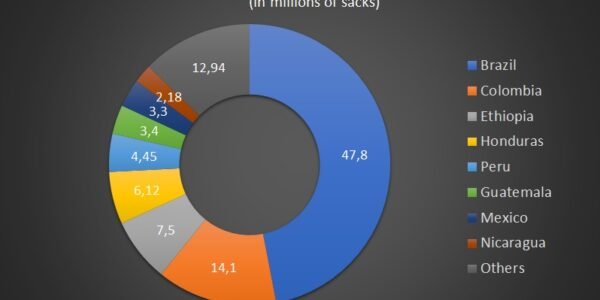

The International Coffee Organization (OIC) differentiates four basic qualities: unwashed Arabic, soft Colombian; others soft or central and robust. The distribution of the market is relatively proportional between these groups. The largest share corresponds to unwashed Arabs, which contribute 28% of world exports. Central and robust coffees each represent 26% of the market and soft Colombians 19%. Although a large number of countries contribute to supply, the eight main producers account for 68% of world exports. The concentration is higher in the various groupings. Thus, Brazil and Colombia account for 92% and 79% of the world production of unwashed and soft Colombian Arabs, respectively, thus exercising a virtual monopoly of such qualities and a great control over the global market.

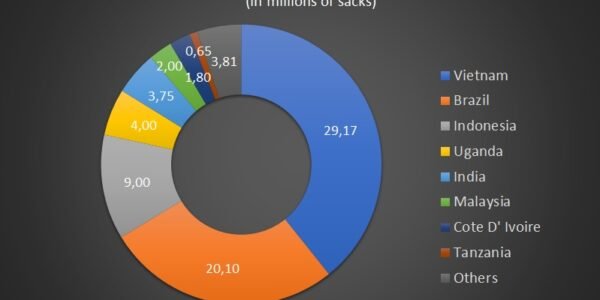

The concentration is somewhat lower in the case of the robust ones, where the three main producers (Côte d’Ivoire, Indonesia and Uganda) concentrate in any case 65% of world sales. Finally, the most competitive market is central coffee, where the three major producers (El Salvador, Mexico and Guatemala) represent 48% of the supply in the world market, but there is a broad set of products in Central America, the Caribbean and Asia.

Global Coffee Production

World coffee production has maintained its upward trend in the long term, standing at the end of 2017 in 158.6 million bags of 60 kg, despite having a negative variation of 0.3% compared to 2016 , has increased by 70% since 1990, according to figures from the International Coffee Organization (ICO), for which, production has been growing significantly in recent decades, and according to the Department of Agriculture of the United States (USDA ), the total production for this year 2018, will be placed in record figures, since it could possibly reach 171 million bags, this increase is already evident with the production registered in the first half of this year by the countries of Brazil and Indonesia, which obtained a harvest of 60 million bags and 11.5 million bags, respectively, with a positive variation with respect to the previous period of 17.6% and 5.5%, according to the data reported by the ICO, which it’s It is very relevant for the market, because these two countries are part of the group of largest coffee producers worldwide, as are Vietnam and Colombia, and between these four countries they cover around 66% of the total global coffee production .

Coffee varieties by geographical area

Colombian Coffee

Coffee, is one of the main export products of Colombia, and plays a very important role in the national economy, also, internationally, the country is positioned as one of the largest producers of grain worldwide, the same Thus, the variety of soft coffee (Arabic) produced in Colombia, is very desirable, especially in the markets of the United States, European countries and Japan, therefore, its influence on the market is quite significant.

Likewise, coffee production by Colombia was placed in 2017 at 14 million bags, decreasing by 4.3% compared to 2016, however, the country continues to be the third largest producer of grain worldwide. , after Brazil and Vietnam.

The coffee harvest in Colombia for the first semester of the year 2018, reached 6.5 million bags, with an increase of 2.6% compared to the same period of 2017, according to the figures reported by the National Federation of Coffee Growers, increasing the possibilities that the production of this year exceeds between 2% and 5%, the 14 million bags of the previous year, generating a greater pressure to the market in relation to the offer.

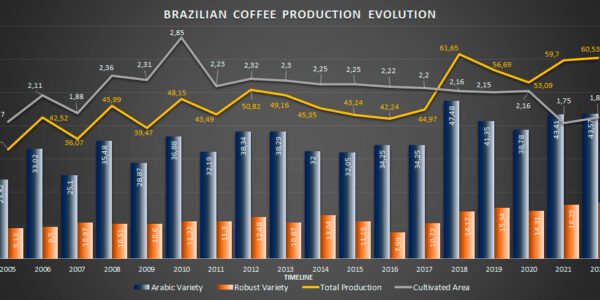

Brazilian Coffee

From January to the end of September 2022, Brazilian coffee exports totaled 28.748 million bags, showing a slight decrease of 3.9% compared to the 29.927 million registered in the first nine months of 2021. shipments yielding US$ 6.730 billion so far, an amount that represents significant gains of 60.4% compared to the US$ 4.197 billion recorded between January and September last year.

“Arabica coffee exports had the best performance in this nine-month interval of the last five years, helping to mitigate the drop in volume so far. The record in foreign exchange revenue in the aggregate of 2022 reflects the favorable exchange rate and the good level of the average price of the shipment, which increases 67% compared to 2021 and reaches US$ 234.12 per bag”.

On the other hand, even with the occasional improvement in the scenario, the president of Cecafé, Günter Häusler, recalls that the bottlenecks in logistics remain challenging. “I never get tired of praising the work of the exporting companies, which, in the face of a reality far below normality in global maritime trade, with higher costs, lower availability of containers, congestion in North American and European ports, lack of bookings , cargo rollovers, among other adversities, continue to unfold and maintain Brazil as a loyal supplier of coffee in terms of volume, quality and sustainability, even with the increase in logistical obstacles in September”, he adds.